Brexit is caused a lot of uncertainty in a lot of aspects of British life. One of those things is the property market as a whole, but about the state of the property market just in the capital where it is usually booming?

It is understandable that the topic of Brexit on the property market is not a straightforward one at all. However, when it comes to London’s property market in regard to Brexit, it is safe to say that there is not a lot of optimism as it stands.

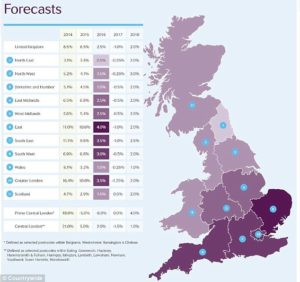

What we have begun to see, even before the deal has been settled, that house prices in London have been falling rapidly and the weakening of the pound seems to have affected London more than other areas in the country.

What we have begun to see, even before the deal has been settled, that house prices in London have been falling rapidly and the weakening of the pound seems to have affected London more than other areas in the country.

The Slowing Down of the Market Post-Referendum

It is true that there was uncertainty around the capital’s property market before the referendum vote was announced. London property prices had been at their peak for several years prior to the Brexit referendum, with both record rents and a large number of properties being sold for over one million pounds. Nonetheless, the market had actually been slowing down as the vote drew closer. Many properties began selling for less than the asking price and fewer properties were even being put on the market.

The Possibility of a No-Deal Brexit

At this moment in time, no deal has been agreed upon by parliament and there is a possibility of a no-deal Brexit deal on the table – especially with Jeremy Corbyn announcing that labour would be voting against Theresa May’s proposed deal.

This possibility of this no-deal exit from the EU has evidentially had a further negative effect on the London property market. Across London and South East, the property experts who work in this area such as surveyors, estate agents and investors, have all claimed to all witnessed a depression in the sales market due to the mass uncertainty.

This possibility of this no-deal exit from the EU has evidentially had a further negative effect on the London property market. Across London and South East, the property experts who work in this area such as surveyors, estate agents and investors, have all claimed to all witnessed a depression in the sales market due to the mass uncertainty.

In addition, there has been a dramatic decline in the number of properties put on the London market. Many are understandably opting to hold onto their property rather than selling in such an uncertain market.

The London market typically sees a far higher number of overseas buyers than the rest of the UK, meaning that the possibility of a no-deal Brexit has really hit the market hard in the capacity.

Very high asking prices mean large investments and for risk-averse investors, it is not worth investing in London at this time. Furthermore, transaction levels are down across London and high-end luxury properties are experiencing a notable downturn.

Stability of the property market lost

UK property has been long regarded as one most stable in the world and unfortunately, this has changed dramatically.

However, the British property market has weathered bigger storms than Brexit. Though it did take some time, the market recovered from the global recession of 2008. Furthermore, even in the current climate, many cities in the north of the UK, most notably Edinburgh, have remained pretty much resilient despite the Brexit vote result.

Is this temporary?

Research which was conducted earlier this year found that 77 per cent of UK based property investors believed that Brexit will not affect their long-term investment strategy. It is believed that once the political climate cools down, the property market in London will begin to pull through this dip.

It was also found by 53 per cent of those surveyed would still rather invest in a traditional asset class like property then a newer and potentially less stable asset class such as cryptocurrency.

It was also found by 53 per cent of those surveyed would still rather invest in a traditional asset class like property then a newer and potentially less stable asset class such as cryptocurrency.

Therefore, many people do believe this property market decline in London as a hiccup until the UK can get back on its feet after taking the blow of what is to be the Brexit deal.